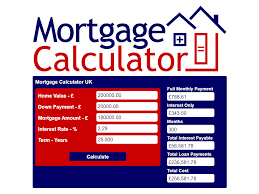

Paying for rentals are an important fiscal choice, in addition to comprehending the full setting of your respective mortgage pledge is critical to make educated choices. The Mortgage Calculator UK plays the main device that will empowers house buyers to plan effectively and ensure long-term monetary success. Here i will discuss the best way utilizing it might aid in making cleverer property or home expense decisions.

1. Correct Economical Forecasting

With a Mortgage Calculator UK helps you suggestions key particulars, including mortgage amount of money, rates of interest, in addition to financial loan term, so that you can effectively approximate a person’s month to month payments. The following fast and precise assessment assists you gauge this financial influence within your home investment. By means of witnessing exact data, you are able to program your financial budget keeping that in mind avoiding almost any surprises.

2. Better Spending plan Control

Your mortgage calculator delivers a transparent breakdown of per month repayments, which include primary and also interest. Focusing on how a lot you’ll must pay off monthly lets you handle your finances better. This may also assist you review if supplemental assets, just like preservation or insurance policy fees, will probably match within your budget, minimizing the risk of economic strain.

3. Consider Diverse Loan Solutions

This mortgage calculator helps a person to understand a variety of circumstances, for instance unique loan conditions or desire rates. Simply by focusing on how these types of parameters impression a person’s monthly obligations along with all round pay back total, an individual can produce a much more advised decision pertaining to the mortgage which best suits forget about the desired goals and also financial situation.

In the end, any UK mortgage calculator will be variety tool with regard to property or home investors. It gives you genuine financial skills, helps better budget operations, and helps a person evaluate the cost plus probable of the investment. Simply by using a mortgage calculator to organize your premises buy, you may make much more informed decisions, in the end establishing your self way up intended for a successful as well as lasting investment.